The Single Strategy To Use For Ach Payment Solution

EFT repayments (EFT stands for electronic funds transfer) can be made use of interchangeably with ACH repayments. They both define the exact same repayments mechanism.:-: Pros Price: ACH payments often tend to be less expensive than wire transfers Rate: faster because they do not make use of a "set" process Cons Rate: ACH payments can take a number of days to refine Price: reasonably costly resource: There are two kinds of ACH payments.

ACH credit report purchases allow you "push" cash to various banks (either your very own or to others). Below are two instances of just how they function in the wild. Many firms offer direct down payment pay-roll. They utilize ACH credit history deals to push money to their employees' savings account at marked pay periods.

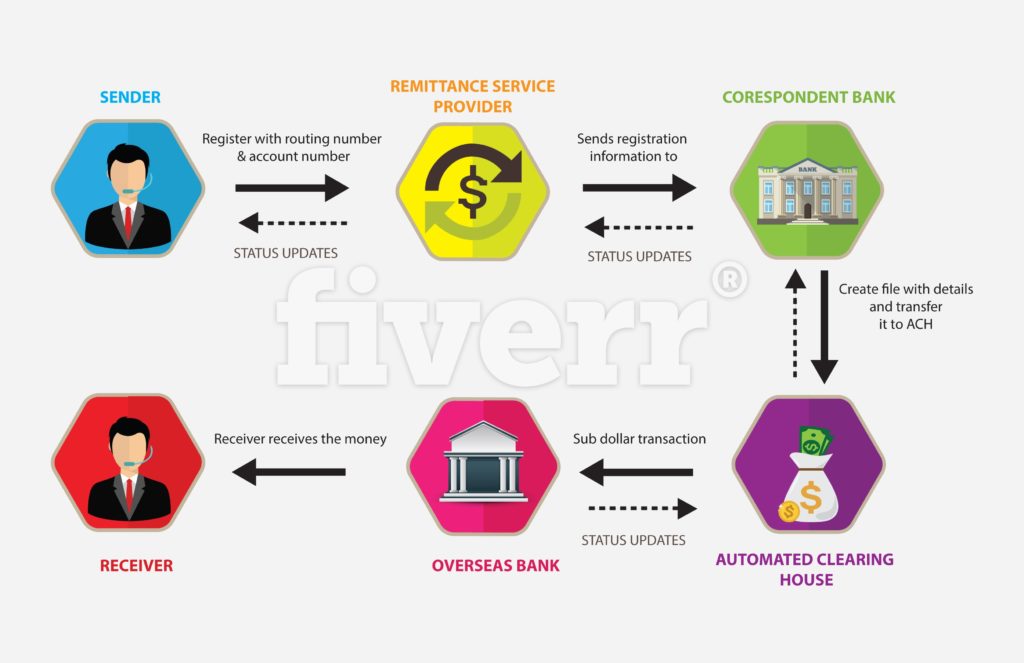

Consumers that pay a service (say, their insurance policy carrier or home loan lender) at certain intervals may choose to register for reoccuring payments. That offers the business the capacity to initiate ACH debit transactions at each billing cycle, drawing the quantity owed straight from the client's account. In addition to the Automated Clearing up House network (which links all the banks in the United States), there are three various other gamers associated with ACH settlements: The Originating Vault Financial Organization (ODFI) is the financial institution that starts the purchase.

What Does Ach Payment Solution Do?

(NACHA) is the detached governmental entity responsible for looking after as well as managing the ACH network. When you sign up for autopay with your phone firm, you give your monitoring account info (directing and also account number) and also sign a reoccuring settlement permission.

Both financial institutions after that connect to make certain that there suffice funds in your financial institution account to process the purchase. If you have sufficient funds, the purchase is processed as well as the cash is routed to your phone company's savings account. ACH repayments generally take numerous business days (the days on which banks are open) to experience.

, financial institutions can choose to have ACH credit scores processed and provided either within a service day or in one to two days. ACH debit deals, on the other hand, need to be processed by the more info here following service day.

The changes (which are taking place in phases) will make feasible prevalent usage of same-day ACH repayments by March 2018. ACH payments are commonly more cost effective for organizations to process than credit cards.

An Unbiased View of Ach Payment Solution

Some ACH cpus bill a flat rate, which normally ranges from $0. 25 to $0. 75 per purchase. Others bill a level percent fee, varying from 0. 5 percent to one percent per deal. Providers might also bill an added monthly fee for ACH repayments, which can vary. Square utilizes ACH repayments for down payments, and also there's no fee linked with that for Square merchants.

These deny codes are necessary for offering the right information to your clients as to why their payment really did not undergo (ach payment solution). Below are the 4 most common decline codes: This indicates the consumer didn't have adequate cash in their account to cover the amount of the debit entry. When you obtain this code, you're possibly going to need to rerun the deal after the client transfers even more money into their account or gives a different payment technique.

It's likely they forgot to inform you of the modification. They need to supply you with a brand-new bank account to process the deal. This code is activated when some combination of the data provided (the account number and name on the account) does not match the bank's records or a missing account number was gotten in.

If a financial institution does not permit a company to withdraw funds from a specific savings account, you'll obtain this deny code. In this instance, the customer needs to provide their financial institution with your ACH Mastermind here are the findings ID to enable ACH withdrawals by your company. You need to rerun the purchase. However, denied ACH repayments could land your organization a fine charge.

10 Simple Techniques For Ach Payment Solution

/ach-vs-wire-transfer-3886077-v3-5bc4cc6d4cedfd0051485d64.png)

To avoid the inconvenience of untangling ACH turns down, it may deserve only approving ACH settlements from relied on clients. Although the ACH network is handled by the federal government and NACHA, ACH settlements don't need to adhere to the exact same PCI-compliance guidelines check my site needed for charge card handling. NACHA calls for that all parties involved in ACH deals (consisting of businesses initiating the payments and also third-party processors) apply procedures, procedures, and regulates to protect sensitive data.

That means you can not send or obtain financial institution info via unencrypted email or insecure web types. Ensure that if you utilize a 3rd party for ACH settlement handling, it has implemented systems with advanced encryption approaches. Under the NACHA policies, masterminds of ACH repayments should also take "readily affordable" actions to ensure the legitimacy of client identification as well as transmitting numbers, and to identify feasible fraudulent activity.

Comments on “Ach Payment Solution Fundamentals Explained”